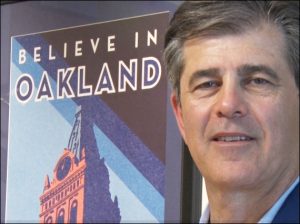

John Protopappas, President & CEO, Madison Park Financial

John Protopappas, President & CEO, Madison Park Financial

When I started this company, I bought a fourplex here in East Oakland. And I bought the building for $90,000. Today we own almost 600 million dollars’ worth of real estate. Summit Bank has been a key part of our success from the time we started because they understand us. They understand our needs. They are a community bank that believes strongly in this community. And so much about community banks is to provide finance and capital for local institutions to grow and develop. That is why Summit Bank has been so instrumental in our success. One of the great benefits of being a customer at Summit Bank is the personalized service. People who know you by your name–by your first name.

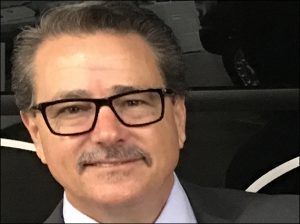

Bill Wheeler, President & CEO, Black Tie Transportation

Bill Wheeler, President & CEO, Black Tie Transportation

We use Summit for all of our banking needs. We use them for deposits, credit card processing, we use them for our payroll processing, we use them for our line of credit… And it’s the expertise of Summit that really allows us to be Black Tie and be able to grow our company and meet the needs of our clients. Even when it is just a casual encounter at the front desk, they say “Hello Mr. wheeler how are you today? Nice to see you. How is your business doing? How is your wife and family?” And they care. It’s a real intimate relationship. Something we just don’t see in any banking relationship. Banks have kind of left the customers behind. And really I talk to people all the time—business associates and people who do business with big banks and really they are just a number and even if they have huge assets in that bank, and they do a lot of deals, they are still just a number. At Summit Bank, they count.

Patricia Bennett, PhD, President & CEO, Resource Development Associates  We were banking with a different bank and we started growing. And pretty soon we realized that because we were growing we needed a larger line of credit. And we went to our old bank and we said “We are growing. Look at our bottom line and everything.“ They said, “You’ve got to fill out all this paper and you’ve got to be interviewed by all these people you have never met before.” And it felt pretty cold. And it didn’t seem promising. And then one day a friend of mine said “Well, you know, you should go talk to Summit Bank!” So I did! There was kind of a personalization. People who actually talked to you. Got to know you. Who were interested in what you did. And they approved a doubling of our line of credit. And we’ve had to go back to them several times because when we first started there were 7 or 9 employees and now we’re up to about 40 or 42. So they have been pretty marvelous in helping us grow!

We were banking with a different bank and we started growing. And pretty soon we realized that because we were growing we needed a larger line of credit. And we went to our old bank and we said “We are growing. Look at our bottom line and everything.“ They said, “You’ve got to fill out all this paper and you’ve got to be interviewed by all these people you have never met before.” And it felt pretty cold. And it didn’t seem promising. And then one day a friend of mine said “Well, you know, you should go talk to Summit Bank!” So I did! There was kind of a personalization. People who actually talked to you. Got to know you. Who were interested in what you did. And they approved a doubling of our line of credit. And we’ve had to go back to them several times because when we first started there were 7 or 9 employees and now we’re up to about 40 or 42. So they have been pretty marvelous in helping us grow!

David Shahvar, President, ButtercuP Diner and Bar

David Shahvar, President, ButtercuP Diner and Bar

We’ve been with Summit Bank for 15 years. Summit Bank has been always there for us and the greatest thing about this relationship is that I know that if tomorrow I find something that I want to explore—an opportunity—I know that Summit Bank is going to come through for me and that’s a great feeling.

Lani Dy, Founder Dy Associates

Lani Dy, Founder Dy Associates

Summit Bank is taking care of all my financial needs. In the last 5 years I’ve been with Summit Bank it’s amazing how I grew and I feel that without a great relationship with a great bank I would not be able to achieve my dream.